Best AI Tools for Consumer Finance

Explore the top-rated tools and popular subcategories for Consumer Finance.

Top 10 in Consumer Finance

Subcategories

New in Consumer Finance

Recently added tools you might want to check out.

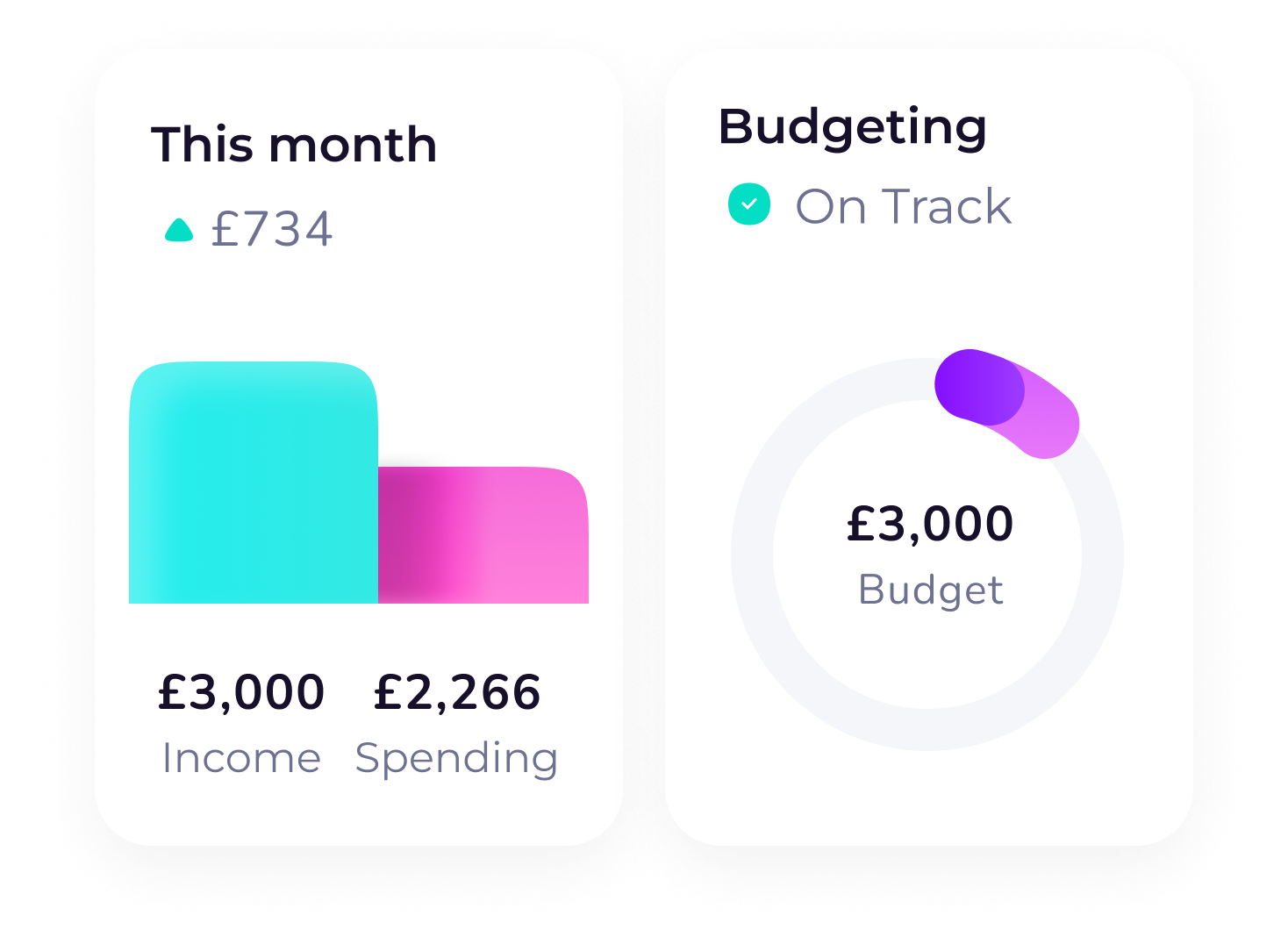

Spendee AI offers a freemium model with a basic free version and premium plans starting at around $2.99 per month for additional features. Notable price points include a…

BuddyBudget AI offers a subscription model with various pricing tiers, though specific price points are not publicly disclosed. The tool is designed to assist users in managing budgets…

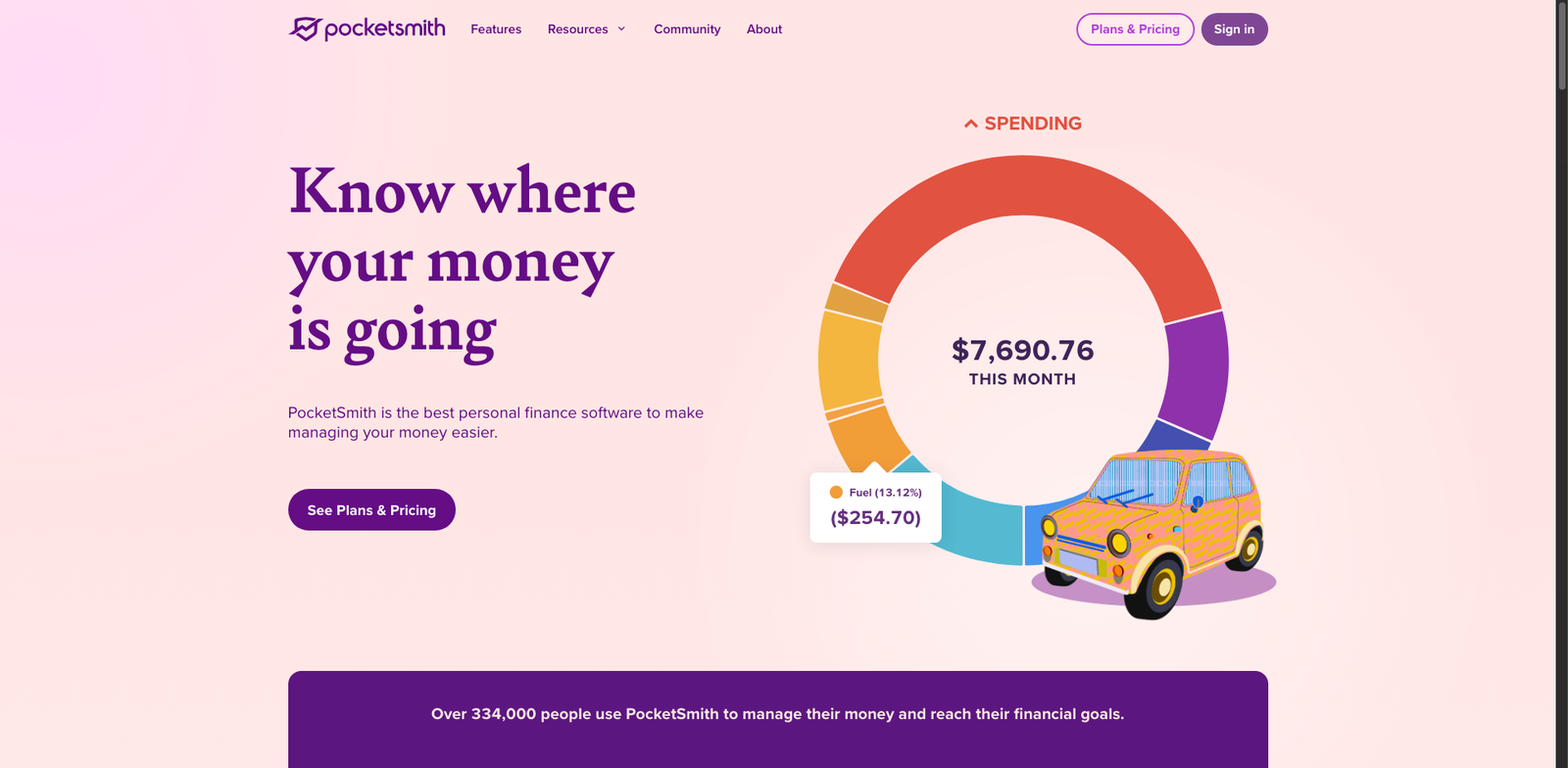

PocketSmith offers several subscription plans, including a free tier and paid plans starting around $10 per month. Notable features vary by plan, with higher tiers providing more advanced…

Humin AI Budget offers various subscription plans, but specific pricing details are not publicly available. Generally, similar tools in the market range from $20 to $100 per month…

Oportun AI offers various plans tailored to different user needs, but specific pricing details are not publicly available. The exact costs may vary based on the services selected.

Digit Save AI offers a subscription model with various plans, but specific pricing details are not publicly available. Users may need to contact sales for exact pricing information.

Betterment Cash Coach offers a financial coaching service with various plans, but specific pricing details are not publicly available. Generally, Betterment’s services are known to have a management…

Truebill Insights offers a subscription model with various plans, but specific pricing details are not publicly available. Users can expect a range of features tailored for financial management.

Plum AI offers a subscription model with various pricing tiers, but specific price points are not publicly disclosed. The exact plans and costs may vary based on user…