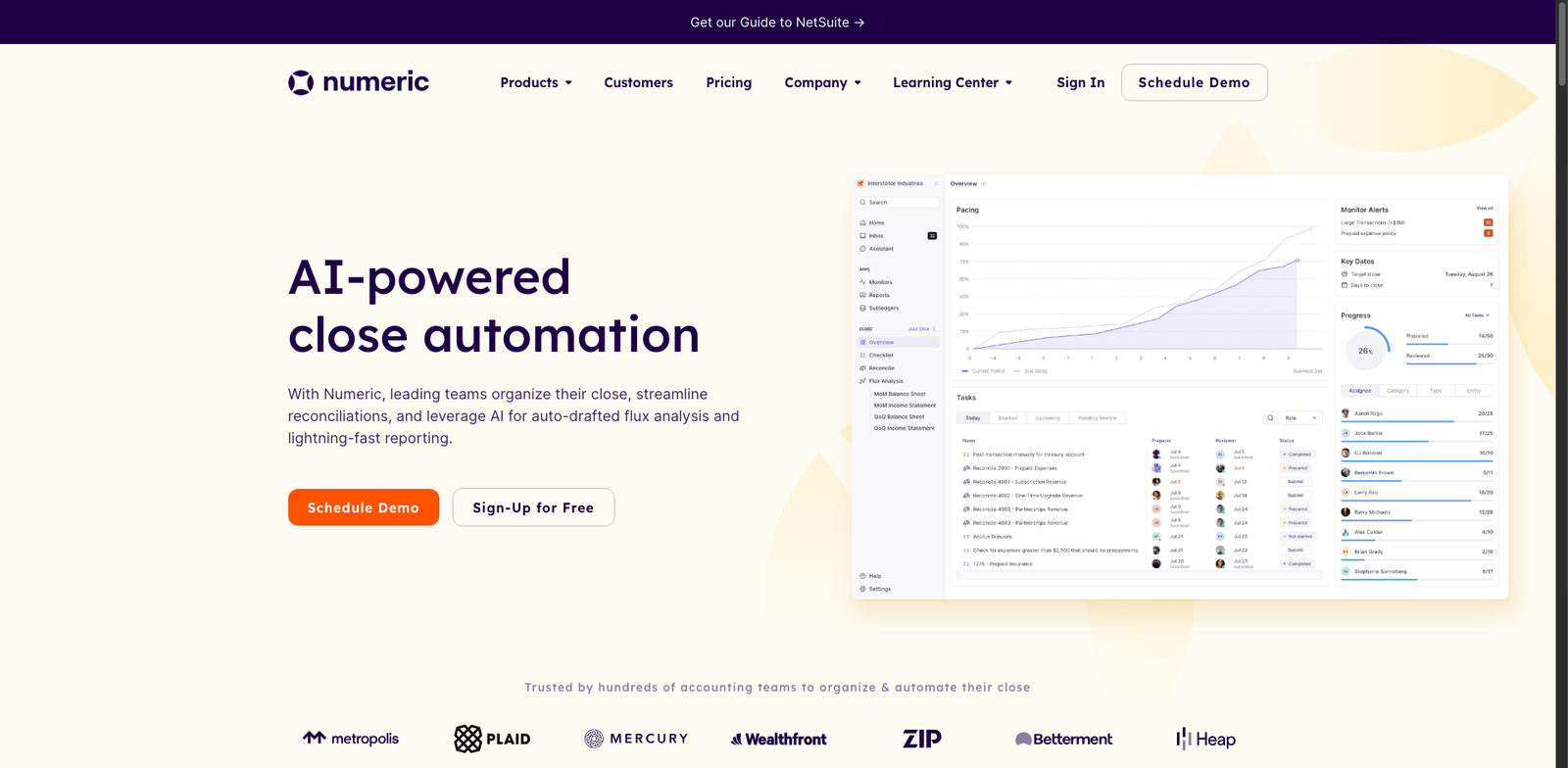

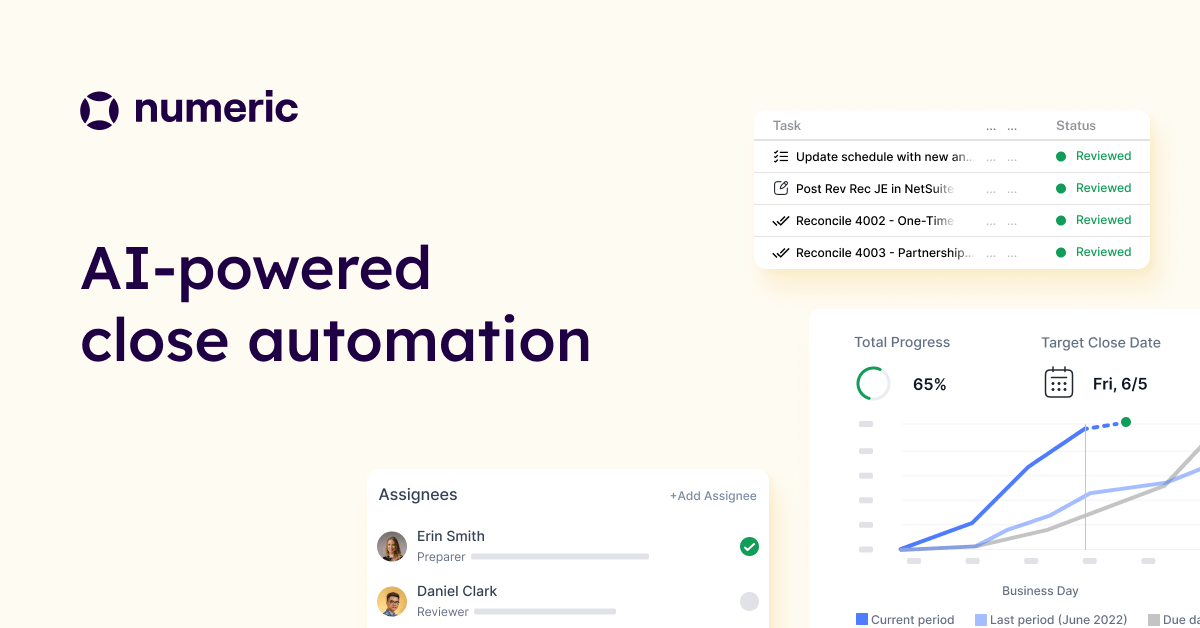

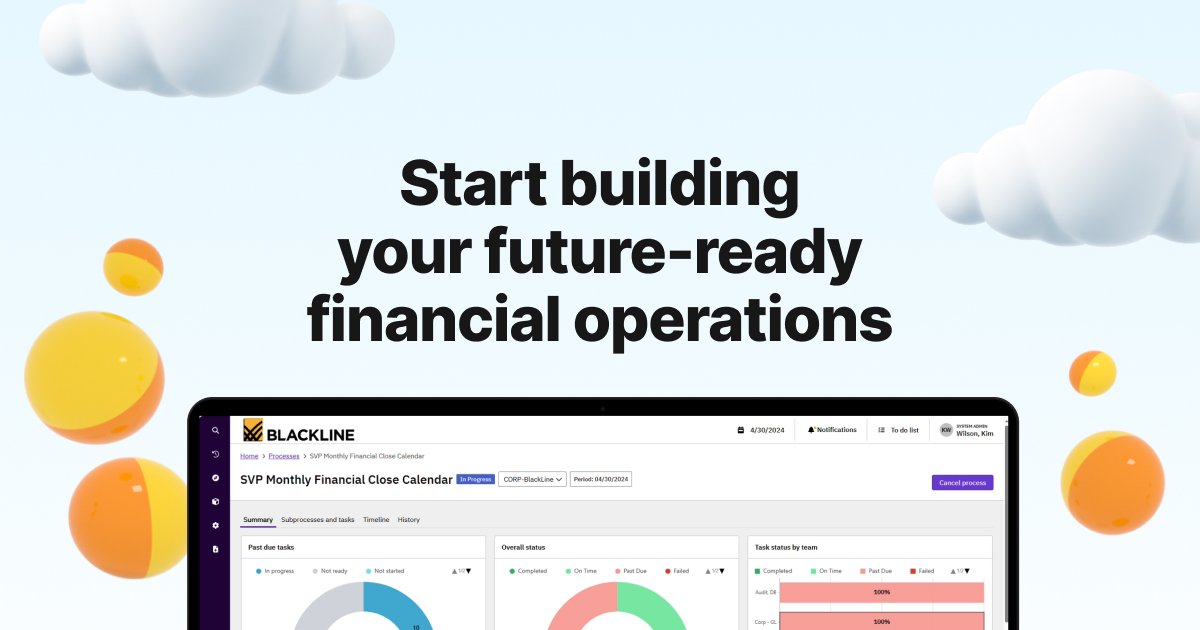

FloQast is a financial close management tool designed for finance teams. It automates reconciliation and reporting, ensuring accuracy and speed.

Key features

- Automated financial close processes

- Real-time collaboration for teams

- Integration with existing accounting software

- Customizable workflows for unique needs

- Comprehensive reporting tools

Pros

- High user satisfaction with a 4.6 rating

- Intuitive interface for easy navigation

- Strong customer support and resources

- Flexible plans that cater to different team sizes

Cons

- Pricing details are not publicly disclosed

- Some features may require additional setup

- Limited integrations compared to competitors