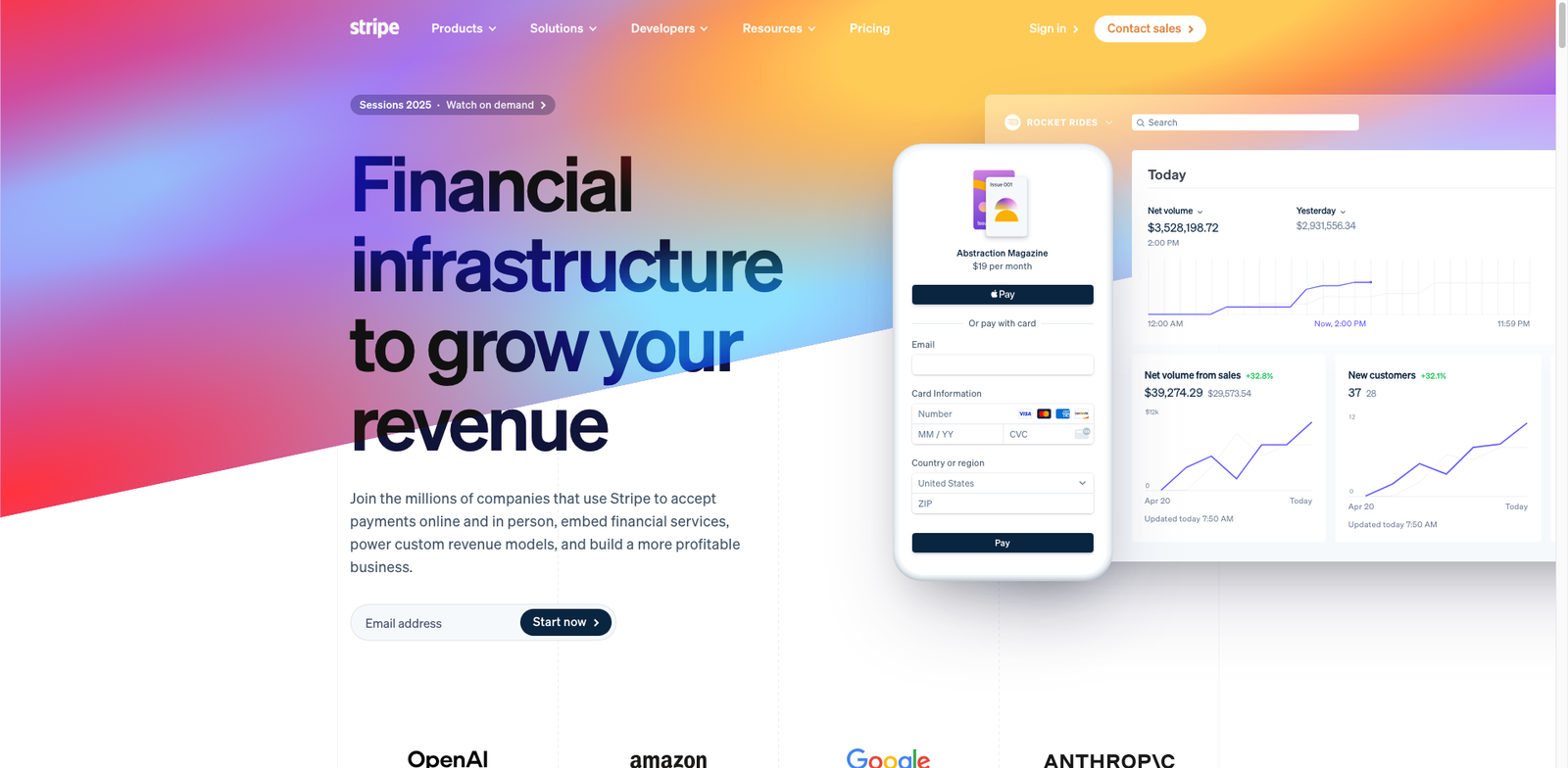

Stripe Billing provides a pay-as-you-go model for managing recurring charges. It’s designed for businesses seeking efficient subscription solutions.

Key features

- Flexible pricing model based on usage.

- Automated invoicing and billing.

- Customizable subscription plans.

- Integration with other Stripe services.

- Robust analytics and reporting tools.

Pros

- Transparent pricing structure.

- User-friendly interface.

- Strong customer support.

- Seamless integration capabilities.

Cons

- Fees can add up for high-volume businesses.

- Limited customization in certain features.

- Learning curve for advanced functionalities.