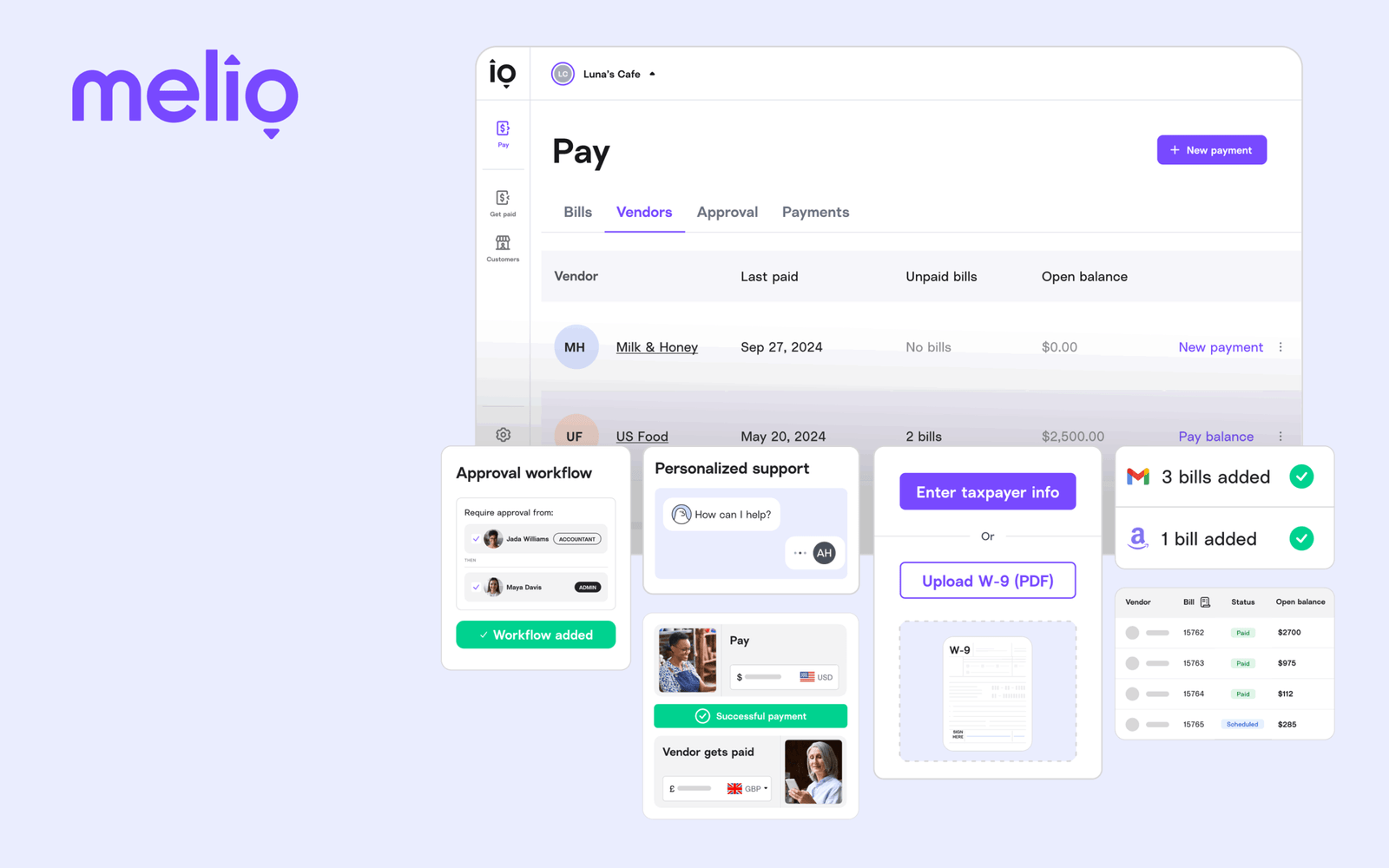

Bill.com AR streamlines your accounts receivable process. It offers tools to manage invoices, payments, and cash flow effectively.

Key features

- Automated invoicing and payment reminders

- Customizable invoice templates

- Integration with popular accounting software

- Real-time payment tracking

- Mobile access for on-the-go management

Pros

- User-friendly interface

- Scalable pricing options

- Strong customer support

- Reliable performance with minimal downtime

Cons

- Basic tier lacks advanced reporting features

- Higher tiers can be costly for small businesses

- Limited customization for invoice layouts